What Is Insurance? How Insurance Works?

The literal meaning of the word insurance means a thing is protecting against a possible eventuality. The idea of Insurance lies in cooperation, sharing, and helping others in their affliction, and when they are exposed to sudden accidents, to mitigate their impact on them and you.

ou might be thinking that insurance companies are just a profit-making marketplace and that you don’t need to buy the Insurance and pay monthly premiums. Are you a skilled driver?! Okay. Do you take good care of your health and diet?! Wonderful thing. Are you very tidy and organized and take care of the house?! Excellent.

But what about life’s unpleasant surprises. Reckless drivers on the roads, sudden pandemics like COVID-19, natural disasters, Earthquakes, floods, and fires. It would help if you rethought how Insurance works to realize its importance and necessity for you and others alike.

What is insurance?

The definition of Insurance is very easy. You will pay a monthly or annual fee to the insurance company. Either to get life insurance, car insurance, or home insurance. In return, the insurance company will pay you financial compensation in the event of an accident or damage to either the person or thing insured.

You transfer the risk of financial loss, which you may be exposed to, to the insurance company, in return for the financial premiums you will pay. Whoever is exposed to a car accident, the insurance policy covers the damage caused to the vehicle. And whoever suffers from a disease or disease, the health insurance policy covers treatment costs. Whoever loses his life, the coverage will be paid to the beneficiaries in the policy. Concerning home insurance, if a fire or flood occurs, for example, the insurance policy covers the damages.

Not only that but there are very strange types of Insurance; you can insure almost everything you want in return for premiums. It is imperative that you benefit from Insurance and get the appropriate coverage according to your needs, priorities, and even your budget.

Insurance is a means of protection against financial loss. It is a form of risk management primarily used to hedge the risk of contingent or uncertain loss.

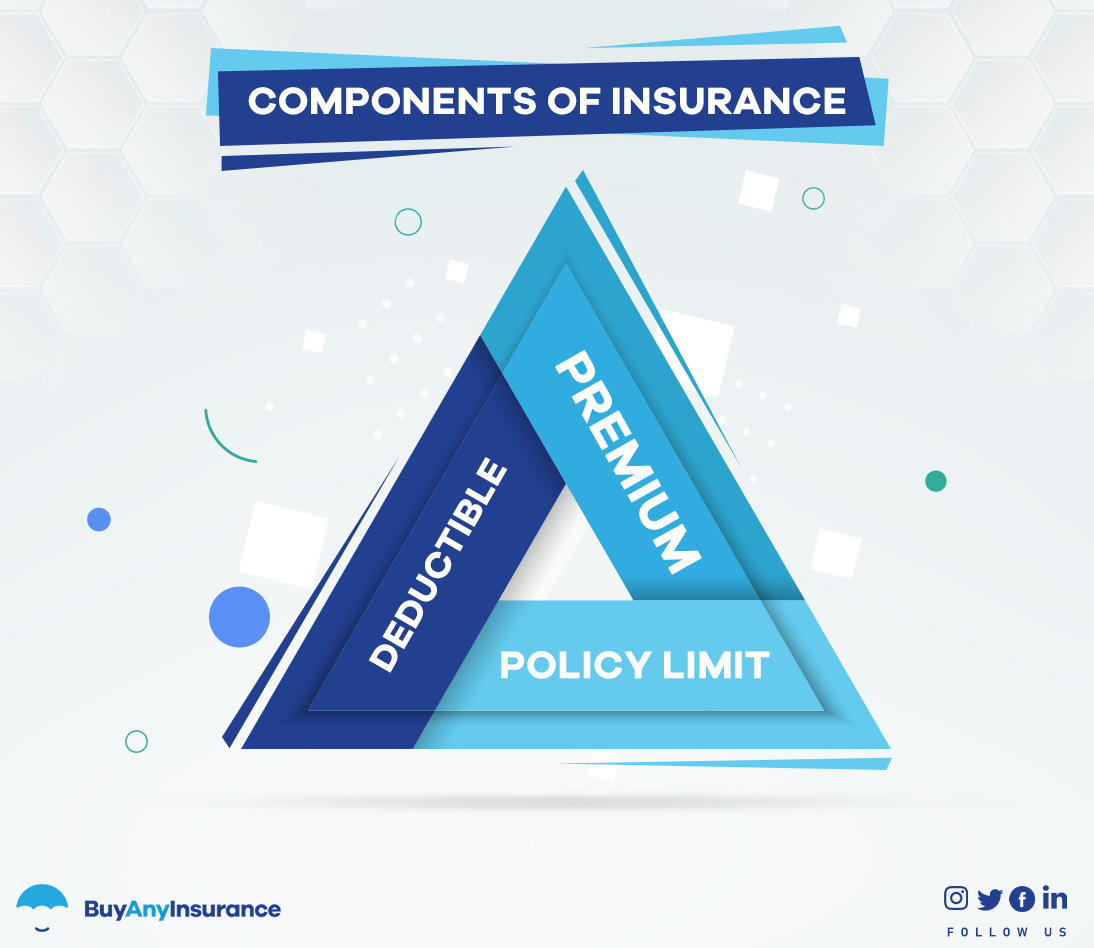

Insurance Components

There are three basic components for any Insurance, which are (premiums, limits of insurance coverage and deductible). By understanding these three components, you can take the most important step in choosing the most appropriate Insurance. For example, third-party car insurance may be the right one for you, or otherwise, comprehensive Insurance may be what suits you best.

Installments

The insurance policy premium is the amount that the insured undertakes to pay the insured for insurance coverage to the insurance company in monthly or annual premiums. Insurance companies set premiums according to several factors, based on your risk profile and whether or not you can claim compensation.

To put it further, if you own several luxury cars and have a track record of reckless driving, you will likely pay higher premiums in terms of cost. At the same time, someone who owns an average regular car and has a perfect driving record will certainly pay lower premiums.

The prices of the documents differ from one company to another, and the features and exclusions differ from one document to another. So finding the right document will take some effort. Or you can contact insurance comparison companies to help you choose the best policy for you.

Limits of insurance coverage

Limits of insurance coverage mean the insurance company’s maximum liability to compensate the insured or insured’s damages, as specified in the insurance policy schedule. This is before applying the deduction or deduction rate or the depreciation rate.

The insurance coverage depends on the period, i.e. the duration of the policy, injury or damage, and other factors. The higher the limits of insurance coverage, the more coverage or benefits you will receive.

Durability ratio

The deductible is the amount or percentage that the policyholder agrees to pay out of their wallet before the insurance company begins settling the claim.

The higher the deductible, the lower the premiums value, and the lower the deductible, the higher the premium value.

Here is the following example: Suppose that your car was involved in an accident that you caused to clarify the idea more. You have insurance coverage of up to 10,000 dirhams, and the deductible is 2,000 dirhams. If the cost of repairing your car damage is 1,500 dirhams, you will pay 1,500 dirhams in full because it is less than the deductible. If the cost of repairing the damages reaches 8000 dirhams, you will pay 2,000 dirhams as the deductible, and the insurance company will pay the rest of the amount, which is 6000 dirhams.

How does insurance work?

The insurance policy is a contract between the insurance company and the insured. The company undertakes to compensate the damages covered by the insurance policy or its annexes in return for the premium paid by the policyholder.

Insurance policies contain all the details of the terms, conditions, and benefits under which the insured receives coverage or benefits from the insurance company.

With Insurance, you can protect yourself and your loved ones from a sudden or emergency financial crisis. At the same time, the insurance company bears the risks and provides insurance coverage for a certain premium.

In an emergency, the insured can submit a claim to the insurance company to compensate for the damages. Then the insurance company will study and settle the claim once it has been approved.

Types of Insurance

There are four basic types of insurance in the UAE, which are car insurance, home insurance, health insurance, and life insurance. There are also other types offered by insurance companies.

Cars Insurance

Car insurance is mandatory by law in the UAE. All vehicles must be secured before they are allowed on the roads. Car insurance helps you cover vehicle damage and personal injury in a car accident.

Car insurance in the UAE is easily available, as many companies offer different insurance policies to suit your needs.

There are two types of car insurance in the UAE, third-party Insurance and comprehensive Insurance. Third-party Insurance pays third-party damages in the event of a collision caused by your fault. It does not provide any coverage for you or your vehicle. At the same time, comprehensive Insurance compensates both parties’ damages regardless of who committed the collision.

Health insurance

Health insurance helps you pay for treatment and drug bills. During the health insurance policy purchase, you agree with the insurance company to pay a percentage of the value of the costs. It may be either in the form of a percentage or in cash in dirhams.

Health insurance, like car insurance, is mandatory in the UAE. This ensures that citizens and residents alike are insured in emergency medical cases.

In addition, in Dubai, employers must provide basic health insurance as part of the employment contract.

Home Insurance

There are three types of home insurance plans available in the UAE, as follows:

Building insurance

As the name implies, this type of home insurance covers the basic structure of the building and pays for claims for repairs and refurbishments of the building. This includes everything from walls, floors, fixtures, fittings, garages, gates, and backyards to fencing.

Home contents insurance

Home contents insurance covers accidental damage, theft, and fire damage to personal property in your home. They include appliances, furniture, paintings, art pieces, and electronics.

Personal property insurance

Just as building insurance does not cover the contents of the house, the contents of the house insurance do not cover some personal items. This includes personal clothing, gems, accessories, and credit cards.

Life insurance

Life insurance pays a certain amount to someone you choose in the policy upon death. Thus, your family can use this amount to pay bills and living expenses. Thus, you ensure your loved ones face the difficulties of material life in your absence.

Insurance companies in the UAE offer various life insurance policies and plans. You can see what suits you best and choose the best insurance plan.

Accidents, diseases, and disasters happen every day, to us or others. What do you think of the idea that through Insurance, you help someone who has had an accident, illness, or disaster every day? Isn’t it a great idea! In the end, carefully choose different research insurance offers and choose the best insurance policy that suits your needs and circumstances.

FAQ’s

What are 3 main types of insurance?

There are three main types of insurance: property, liability and life insurance.

What is insurance risk?

Insurance risks is the uncertainty that arise from the occurrence of possible events.

What are the contact details of insurance authority UAE?

You can call and email to the insurance authority of UAE between 7:30AM to 2:30PM from Thursday to Sunday. Here are the contact details:

Call: 800(AUAE)42823

Email: [email protected]

What is insurance third party?

A third-party insurance is the type of car insurance cover that only covers for the third party damages. The person receiving the claim would be the one whose car has been damaged by the policy holder’s vehicle.

Related Article:

Glossary Of Insurance Terms That You Need To Know

Originally published Jun 26, 2021 22:53:44 PM, updated Jun 05, 2024