A Guide to Personal Injury Accident Claims in Dubai

Ever since car insurance was made mandatory by law in the UAE, the driving culture has changed. Drivers tend to be more careful now. Traffic accidents have reduced considerably over the past few years.

However, they have not been eradicated. Roadside collisions still occur. People are injured as a result and require time and support to recover. It is where your insurance cover comes in. But what is a personal accident cover?

Personal Accident Cover

Also known as personal injury insurance, it is an added feature to your car insurance policy. It is designed to provide compensation in case of injury or death as an immediate result of an auto collision or accident.

It is a form of protection you add to your existing insurance. It can be a great boon in times of injury, as it can be used to pay medical bills and expenses.

So how do you make sure that you get the most benefit in case of an injury? We’ll tell you how.

Do You Have the Right Insurance?

More often than not, a claims process comes to an end before it begins because the policyholder doesn’t have the right kind of insurance. Third-Party Liability Insurance, for instance, doesn’t cover any damages, auto or personal, for the policyholder. Comprehensive Coverage does cover auto damage and a little personal injury but is it enough?

Conduct extensive car insurance comparisons. There are several online platforms you can turn to. BuyAnyInsurance is a great resource for insurance comparison. You can research policies that offer great personal injury accident features. Just ensure that you get the insurance that covers all your concerns.

Be Aware of What Your Insurance Includes

Before you sign on the dotted line, know what is included in your policy. Ask specific questions about personal injury accident claims. Make sure you find out exactly how much the company will cover. Confirm the circumstances that could cancel your claim before signing.

Check the exclusions carefully. Personal injury accident claim is a very vague term. Most policyholders assume it automatically includes every medical injury and emergency procedure, but this isn’t true.

Your insurance policy will specify which injuries and medical procedures are included in the personal injury accident claim. So read up on your policy.

Invest in the Right Vehicle

What you drive will greatly impact your premium and, eventually, your claim. Old and second-hand cars that have already been in a collision will be harder to claim personal injury.

The insurance provider will see them as risky and unreliable as they have already let their drivers down. Because you risk driving the car, the insurance company can wash their hands off any responsibility.

Brand new cars with built-in protective features, on the other hand, offer far more security in terms of collisions, and because of this protection, they are deemed less risky. So if you end up in an accident while driving them, you can expect a higher personal injury accident claim.

If any modifications are made to the insured vehicle, then the insurance provider should be consulted and kept up to date at all stages.

If you get modifications done after the insurance has commenced and do not inform your provider, they can claim that the car does not match the form description and reject your claim. Insurance policies are designed around the car, and if there are modifications, the policy will have to change accordingly.

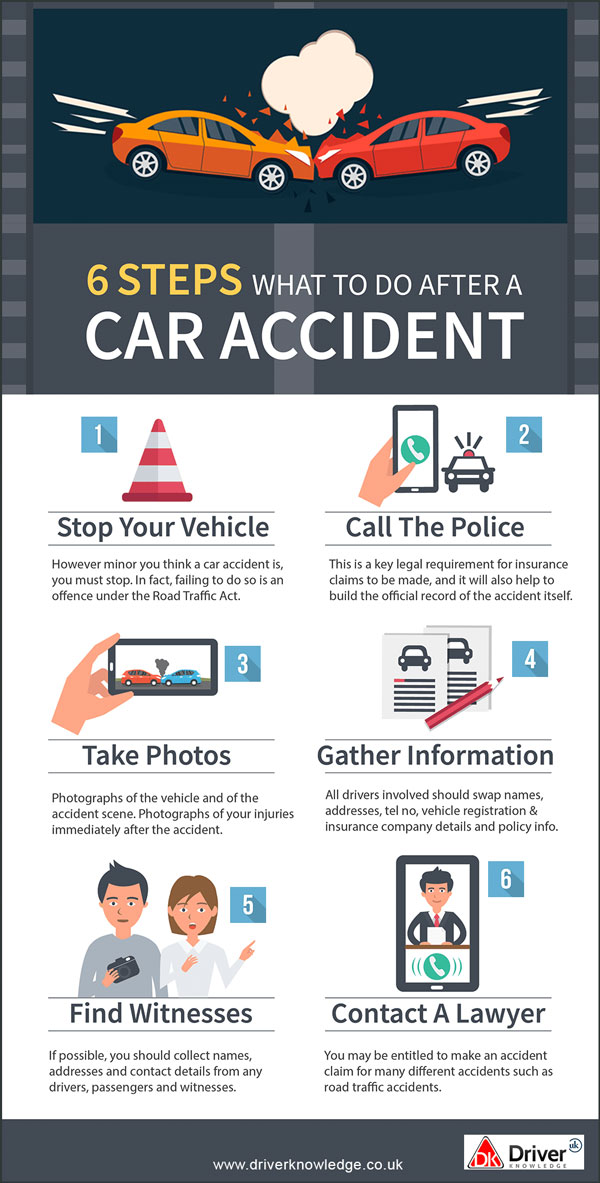

Inform the Police and Get A Report

The first thing you should do after an accident is calling the police. They must make an accurate police report of the incident. They are trained to determine fault, and their report can be the best form of proof of whose fault the accident was.

It is important to decide how much you can claim and what purpose. It will save you a lot of headaches during the claims process if the report is as detailed.

Get a Medical Report

You need to submit a medical report for personal injury or accident claims. You need to be assessed by a certified healthcare physician who can then make a medical report of your injuries and the treatment you were given in the hospital. This report will ease the claims process as well.

Take Photographic Evidence

Though the police will come up with their report, it doesn’t hurt to take photographic evidence of your own of the collision as soon as it happens. Maybe you’ll get some evidence that the police might miss if they are delayed by a few minutes to get to the location.

Get Witness Reports

Talk to the people who were there when the accident happened. Get their information and ask them if they would be willing to testify to what they witnessed. Submit their names and contact information to your insurance company with your claim.

Get the Other Patry’s Information

Don’t forget to get the details of the other party involved in the collision with you. Note down their license plate number.

Ask for their name, driver’s license number, and if the car is registered under their name. Get their insurance information to make the process easy for both of you when making a personal injury accident claim.

Inform Your Insurance Provider

As soon as you can, inform your insurance provider of the collision. Get the ball rolling on the claim so that the insurance company knows that a claim will be coming soon. This way, they can’t say they were blindsided. You can’t expect swift claims if you delay informing the provider.

Inform Your Lawyer

Get your lawyer on board. If your injuries are substantial, you’ll want someone to represent you and make sure your claim goes through smoothly. Delegate this task to your lawyer.

They are experts in their field and will be able to give you good advice on how to move forward.

Keep a Record of All Bills and Receipts

For the claim, keep a record of all the bills and receipts you accumulate during the claims process. Car repair bills, medical bills, and loss of earnings should all be documented and filed with your claim.

Be Honest. Don’t Hide Anything

Insurance providers hold in-depth investigations into an accident or collision, so it would be foolish to withhold important information. It could be used against you and lead to a complete rejection of your claim or termination of your policy.

The claims process can be lengthy and frustrating. But if you follow our tips, it doesn’t have to be futile. At BuyAnyInsurance, we pride ourselves on having your back and helping you reach your insurance goals. Our dedicated experts are always on call to help you with your claims concerns. We’re here to make it easier.

FAQ’s

How to claim insurance for car accidents in Dubai?

You need few documents to file for accident claims in Dubai:

- Police Report

- Car registration document

- Car modifying certificate

- Driving license of both parties

- Filed insurance claims for both parties

Does a personal injury claim affect the insurance?

Yes! But this only happens when you claim the personal injury on the insurance that only covers the vehicle repairs.

How to claim motor insurance accident?

You will need few documents to claim motor insurance accident:

- Policy Number

- Police/Saeed Report

- Car registration card

- Driving License

- Incident Details

- Insurance claim form

Related Articles:

What Are The Essential Documents Required For Car Insurance?

Online Car Insurance Trends In the UAE

What You Need to Know About Car Insurance Dubai

Contact Us:

Originally published Oct 23, 2020 14:32:00 PM, updated Jun 06, 2024